New PV system owners will have until the end of 2019 to qualify for the full 30% Investment Tax Credit (ITC) before its inevitable step-down. The clock is ticking!

The ITC is the most impactful Federal policy creation designed to incentivize the U.S. solar industry’s growth, and its step-down is sure to shake things up a bit. Change can be scary and preparation is crucial, but in spite of the upcoming ITC reductions, the industry is poised to continue its growth trajectory.

A History of the ITC

The Solar ITC originated in 2005, when the 109th Republican-controlled Congress passed an energy bill focused on energy generation and efficiency which would later become the Energy Policy Act of 2005. Part of the bill included tax incentives designed to support the growth of new, energy energy-efficient, and sustainable technologies. The Solar ITC became a part of the package, setting the stage for the growth of solar in the United States. Initially set to last two years, the ITC was extended on three separate occasions: once in 2006 for the Tax Relief and Health Care Act of 2006, then again in 2008 during the economic recession thanks to the Emergency Economic Stabilization Act of 2008, and most recently at the end of 2015.

-

2005: Energy Policy Act of 2005 initiates a 30% investment tax credit for residential and commercial solar (effective January 2006 to December 2007).

-

2006: Tax Relief and Health Care Act of 2006 extends credits for an additional year

-

2008: Emergency Economic Stabilization Act of 2008 extends ITC by eight years

-

2015: Solar ITC is extended until 2020, when the step-down to 10% for commercial solar only takes into effect 2023 and beyond

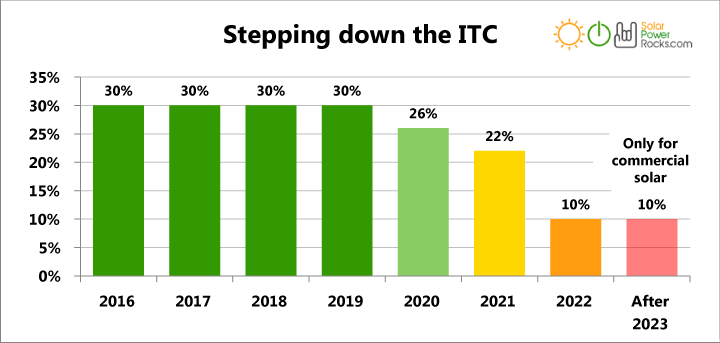

Overview of the ITC Stepdown

As it stands right now, the ITC will reward new solar PV system owners 30% of a project’s cost if installed in 2019. This number will reduce to 26% in 2020, 22% in 2021, and 10% in 2022 where it will remain exclusively for utility and commercial projects. This means that by 2022, homeowners can no longer collect on a direct tax credit. The chart below showcases the step-down visually.

*Graphic by SolarPowerRocks.com

Looking Ahead: Beyond the Stepdown

In the short term, particularly for 2019, the imminent ITC step-down will incentivize future system owners to act quickly in order to take advantage of the highest possible tax credit. This means increased industry demand for solar equipment and labor, especially in the busy Q4 months. Installers are strongly urged to lock down equipment needs and secure contracts for clients eager to maximize their ROI as early as possible. This will set installers up for success through the end of 2019.

So how does the solar industry fare as the ITC ramp down inches its way closer to 10% and beyond? The ITC has experienced a few extensions in its 14-year life, especially during earlier times of industry immaturity. The solar industry now, although consistently tested by market fluctuations due to events like 2018’s Section 201 Trade Case and supply constraints, is in a much better position than before when an earlier ITC step-down was of much greater concern. With falling solar equipment prices and soft costs in the last five years, ambitious state and local renewable energy targets, and lucrative financial structures in place, solar is here to stay with or without the ITC.

Lock in your 2019 equipment, design, and engineering needs with Greentech Renewables. Our team of solar experts is equipped to help you with your projects. Contact your dedicated Account Manager today.

Further Reading: