In recent years, the renewable energy industry has witnessed a remarkable surge in the adoption of solar energy solutions by businesses seeking to reduce their carbon footprint and lower energy costs. To achieve its goal of 100% clean energy by 2035, the federal government introduced solar tax credits to incentivize homeowners and businesses to invest in solar systems. In this overview, we will delve into the various federal solar tax credits available to businesses and highlight some of their associated requirements. Please note that the content of this article is intended to provide insight to solar installers in assisting their commercial customers in making informed decisions and is not intended as financial advice.

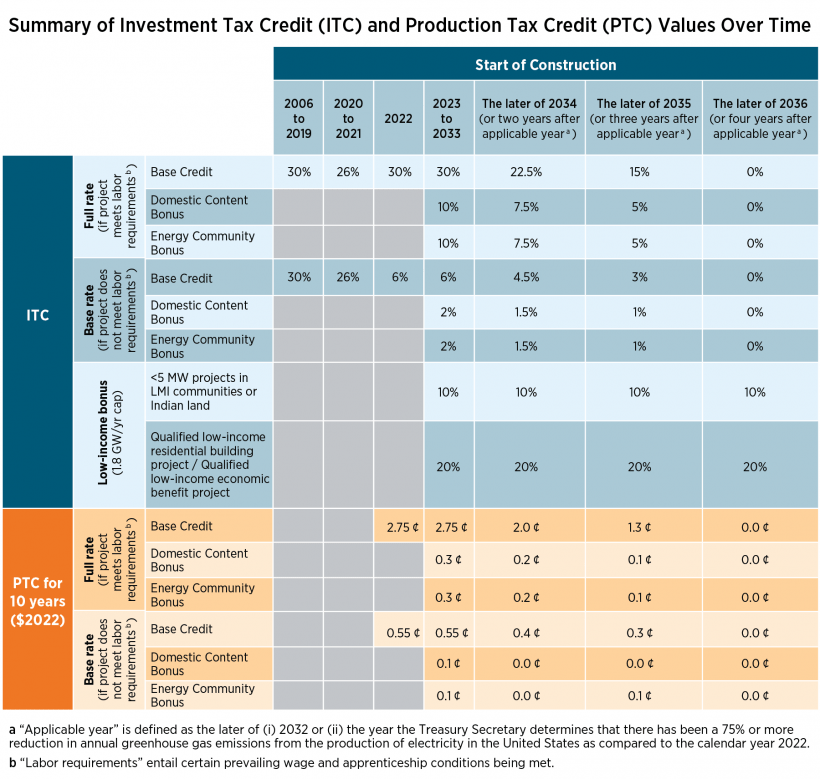

For businesses and non-profit organizations that purchase solar systems, two primary tax credits are available, the Investment Tax Credit (ITC) and the Production Tax Credit (PTC). Greentech Renewables has covered the ITC in previous articles. According to the Office of Energy Efficiency and Renewable Energy (EERE), businesses can only utilize one of the tax credits per property. Below is a chart summarizing both credits and their values over the life cycle of a commercial installation.

(Source Credit: EERE - Solar Technologies Office)

Investment Tax Credit (ITC) and Production Tax Credit (PTC)

Businesses can choose to take advantage of either ITC or PTC based on the size of the project, local environment, sunlight availability, and added credit eligibility. To qualify for either tax credit, construction for commercial projects must begin before January 31, 2024. The ITC has played a pivotal role in driving solar and energy storage adoption among businesses. Similar to homeowners, the Section 48 - Energy Credit allows businesses to deduct a percentage of the cost of their solar energy system from their federal tax obligation. The current ITC percentage is 30%, based on project cost, labor standards, and apprenticeship requirements. Additional ITC criteria include operational readiness for use and system ownership.

The ITC is generally used for commercial projects in areas with less sunlight, as the upfront credit is not tied to the solar array’s performance. Thus, the ITC can grant relief for businesses installing projects in geographic areas with lower production. Bonus credits are also beneficial for companies that might not have qualified for ITC percentages but would like to take advantage of added federal incentives. In considering claiming the ITC, understanding expense and property eligibility is critical. According to the EERE, eligible properties can include inverters, solar modules, solar racking, BOS products, transformers, energy storage devices with a 5kW or greater capacity rating, installation costs, and more.

Commercial solar projects must meet specific energy production criteria to claim the PTC. The energy produced by the solar installation contributes proportionately to the project’s credit eligibility. Similar to the ITC, the solar system must be owned by the business or organization claiming the credit. According to the IRS, monthly credit amounts equal the same as the tax credit for each month. The PTC is generally considered a more strategic option for commercial projects with estimated high returns due to factors like sunlight availability, module orientation, or latitude. If a system is projected to perform well given these factors, business owners can feel confident in the PTC being tied to their system’s production.

Business owners can take advantage of additional tax credits, including the domestic content bonus, energy community bonus, and low-income bonus. For products manufactured in the US that meet a total project material percentage, companies can qualify for an added 10% credit with either ITC or PTC. The Energy Community Bonus consists of three elements involving the utilization of MSA or non-MSA areas, abandoned sites, and census areas. Lastly, commercial projects that are constructed in low-income communities can be eligible for an additional 10% low-income bonus credit. Additional details can be found in the latest IRS guidelines.

Understanding current IRS requirements is crucial in determining which tax credit would be most valuable for business owners, as each business is required to meet labor requirements at the prevailing rates of specific geographic areas or construction sites set by the Secretary of Labor. If these determinations have not been set, the company is required to contact the Department of Labor at IRAprevailingwage@dol.gov to provide project-specific details, including the construction site location, job duties, wage rates, and any additional pertinent project information. Prevailing wage requirements can be fulfilled by paying additional fees to the Department of Labor and any wage discrepancies plus interest.

Additional Tax Benefits:

MACRS Depreciation

Businesses that claim ITC can also benefit from the Modified Accelerated Cost Recovery System (MACRS) depreciation. This incentive structure allows owners to recover the cost of their solar and energy storage systems by reducing tax obligations over a predetermined period. For eligible solar and energy storage systems, the MACRS recovery period is currently set at 5 years. This depreciation schedule can offer substantial savings for businesses by reducing their taxable income during the solar system's lifecycle. In generating solar power for commercial use, companies can ultimately reduce their bottom line. To help optimize commercial customers’ depreciation strategy and ensure accurate documentation and reporting, solar installers are encouraged to work with local tax professionals for insight.

Solar Equipment and Property Tax Exemption

Businesses investing in commercial solar and energy storage systems in different states can also benefit from property and equipment tax exemption. Currently, 25 states offer solar tax exemptions. These exemptions help relieve businesses from paying property taxes on the added value of the solar system. As each state varies in tax regulations, solar installers should be knowledgeable about their state’s rules and exemptions for commercial solar projects.

Federal Grants and Incentive Programs

Beyond tax credits, business owners can explore various federal grants and incentive programs that provide financial support for commercial solar energy projects. These programs may vary in availability and scope, so being informed about the latest opportunities and each application process is valuable for solar installers across the country.

Federal solar tax credits and incentives can motivate companies to shift toward renewable energy and gain financial benefits. For solar installers, staying updated on the latest federal regulations, credits, and incentives to guide commercial customers in making informed financial decisions will help create strong customer relationships. By effectively guiding businesses and organizations through the intricate landscape of solar incentives, installers can play a pivotal role in accelerating the transition to sustainable energy solutions. At Greentech Renewables, we go beyond supply with our comprehensive services to support installer customers, including finance solutions and credit services. Contact your local Greentech Renewables to get answers to your finance and tax credit questions.