This evolving picture routinely delivers a combination of encouraging and sometimes disheartening developments. While the industry rejoiced with the extension of the federal Investment Tax Credit (ITC) in December of 2015, the following month saw a step backwards for rooftop solar in Nevada. Overall solar policy remains robust and supportive. The need for new solar capacity also remains strong as aging coal and nuclear plants go offline across the country. This article will serve as a synopsis of policy developments that occurred in the first quarter of 2016.

Maine

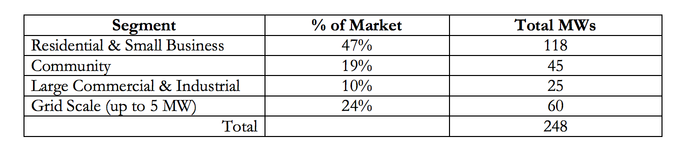

Maine is in the throes of a solar renaissance. With only 20 MW of solar currently installed new legislation proposes a revamped rate structure for distributed solar resources aimed at developing 248 MW through 2022. Under the current net metering scheme solar owners are compensated at a fluctuating kWh rate for excess generation. Under a new proposal solar installations under 250kW would enter into a 20 year fixed-rate contract with utilities for generation exported to the grid. The kWh contract price would change over time as the number of installations in the state increases and the 248 MW goal is approached. Larger commercial and community solar installations would sell their 20 year contracts at annual reverse auctions for the full output of their solar generation. Once the system is operational these customer will receive a bill credit.

Under the proposed legislation 163 MW of the 248 MW program would be set aside for residential, small business and community solar systems. For systems of all sizes solar generation is to be aggregated and sold into the New England electricity market by the Maine utilities.

Although this new legislation initially received widespread support from a range of stakeholders, as of recently there has been a push to by Maine solar installers to embrace current net metering practices over adopting new legislation. Despite Maine representing a small segment of the US solar market, progress and developments to the state’s solar policy will be watched closely on the national stage as many states face similar choices pertaining to their own net metering programs.

Massachusetts

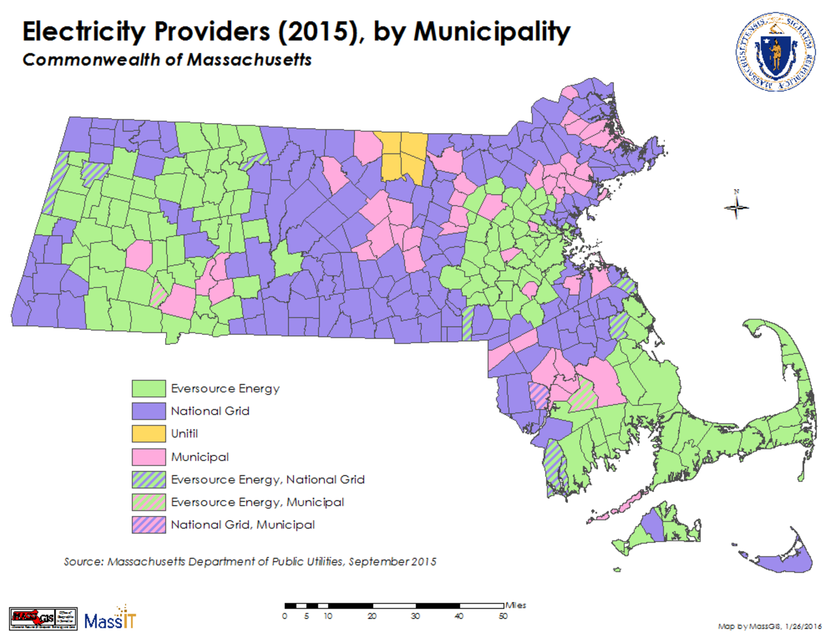

Massachusetts is home to one of the nation’s most vibrant solar markets. The states hosts over 1GW of residential, community, commercial and utility scale installations. In recent weeks many of the larger projects have come to a screeching halt as two of the state’s most impactful incentives reached their legislative limits. While net metering caps are impacting installations in National Grid territory, all projects over 25kW can no longer qualify to generate MA solar renewable energy credits (SRECs). Although only 1,000 MW of the 1,600 MW SREC allotment has been built, the remaining capacity has been fully subscribed. Until hard details emerge on the next SREC-based program larger solar developments are on hold in the state.

On a more positive note, over two-thirds of the MA House of Representatives has signed their support in favor of a bill that would increase the net metering caps. This pro-solar group has petitioned to maintain the full retail rate of compensation for excess generation from rooftop and community-shared solar projects alike.

Pennsylvania

Rooftop solar took off in PA with the launch of the Sunshine Solar Program in 2008. Rebates from this program paired with a healthy SREC market saw the number of solar installers increase by a full order of magnitude in a matter of a couple years. A glut of SREC supply paired with the exhaustion of the Sunshine rebate fund ultimately led to retrenchment of the solar industry in PA. The state of solar in PA may be on the cusp of a revival with the PA PUC recently voting to preserve full retail compensation for net metered solar energy fed back into the grid. Utilities also sought review of the capacity limit for distributed solar resources. Rather than bowing to the utilities request for systems limited to 110% of the facility's/home’s historical usage, a compromise was struck at 200% or 50kW. These developments are first steps on the road to recovery for the PA residential solar market.

South Dakota

For a short period of time the state of solar in South Dakota seemed to be looking bright. In the absence of retail net metering common is many other US states, solar customers in South Dakota are compensated at the avoided cost of generation. Although this is good practice in attaining a partially accurate picture of the value of distributed solar, the rate of compensation in SD varies by utility provider. Last month legislators considered a bill that would standardize the avoided cost compensation across the state. Solar advocates hoped this standardization would pave the way for increased solar in the state by providing customers across the state with similar payback periods. Unfortunately a legislative committee squashed the bill in a 11-2 vote. Although SD is home to cheap electricity and little in the way of solar incentives, declining costs of solar and the shuttering of aging coal plants will spur solar growth in coming years and decades.